MultiCharts Paper Trading: A Comprehensive Guide for Aspiring Traders

It is true that practice makes perfect when it comes to trading. But, especially for novices, using real money for practice can be costly and dangerous. This is the context in which paper trading is useful. Traders can mimic actual market conditions with paper trading without having to risk real money. MultiCharts paper trading, a professional trading software renowned for its potent analytics, charting tools, and broker compatibility, is one of the top platforms providing this crucial feature. We’ll look at how to utilize MultiCharts for paper trading in this blog and how it can improve your trading techniques.

What is multicharts Paper Trading?

Let’s define paper trading before delving into MultiCharts’ intricacies. Purchasing and selling securities in a virtual setting is known as paper trading. This enables you to test ideas, hone your abilities, and comprehend market dynamics before investing your capital by enabling you to make hypothetical transactions without spending real money.

- Comprehensive Features: MultiCharts offers a wide range of features, including historical data, real-time quotes, various order types, charting tools, and backtesting capabilities. This comprehensive suite allows for a realistic trading experience.

- Customization: MultiCharts provides a high degree of customization, enabling traders to tailor the platform to their specific needs and preferences. This flexibility is crucial for creating a personalized trading environment.

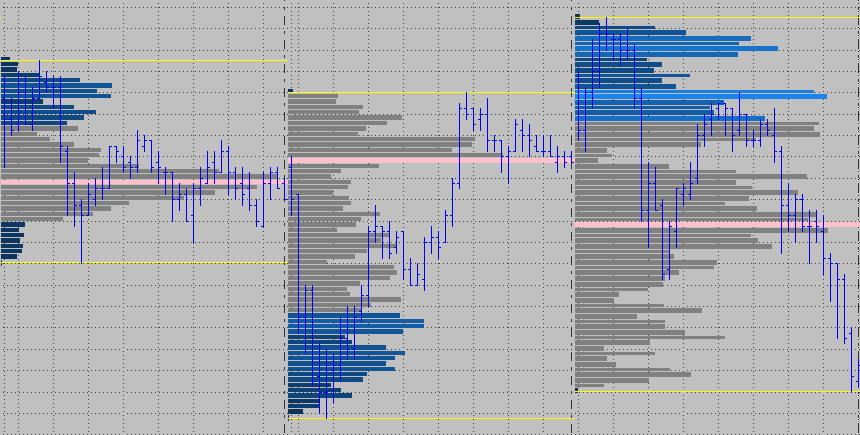

- Backtesting Capabilities: One of MultiCharts paper trading’ standout features is its robust backtesting capabilities. Traders can test strategies against historical data to assess their potential profitability and identify potential flaws.

- Community and Support: MultiCharts paper trading has a large and active community of traders who share knowledge, strategies, and support. This can be valuable for learning from experienced traders and finding answers to questions.

- Integration with Live Trading: If you decide to transition to live trading, MultiCharts can be seamlessly integrated with your brokerage account. This allows for a smooth transition and consistent trading experience.

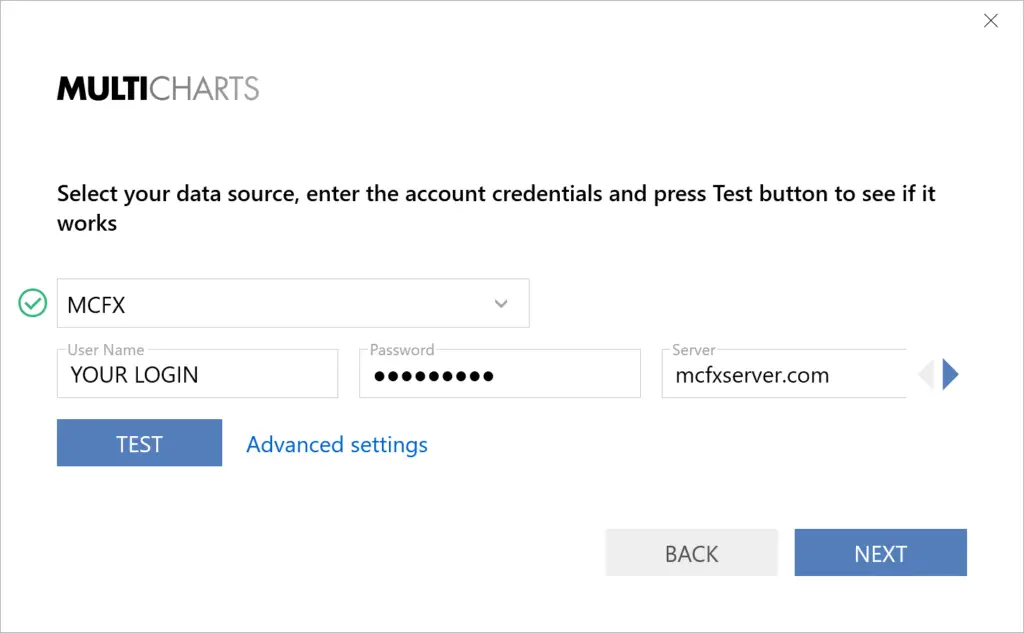

Setting Up Multicharts Paper Trading

1. Create a New Paper Trading Account:

- Open MultiCharts and navigate to the “File” menu.

- Select “New Account.”

- Choose “Paper Trading” as the account type.

- Provide a unique name for your paper trading account.

2. Configure Account Settings:

- Specify the initial balance for your paper trading account.

- Set the currency you want to use for trading.

- Configure any other relevant settings, such as commission rates or slippage.

3. Import Historical Data:

- To backtest strategies or analyze historical market data, import historical price data for the instruments you want to trade.

- MultiCharts supports various data sources, including CSV files, databases, and real-time data feeds.

4. Create a Trading Strategy or System:

- If you have a pre-defined trading strategy, create or import it into MultiCharts.

- Alternatively, you can build a new strategy using MultiCharts’ built-in programming language or by using predefined indicators and tools.

5. Test Your Strategy:

- Run a backtest to evaluate your strategy’s performance against historical data.

- Analyze the results to identify strengths, weaknesses, and potential improvements.

- Adjust your strategy as needed based on the backtest results.

6. Start Paper Trading:

- Once you are satisfied with your strategy, switch to live paper trading mode.

- Place orders and execute trades based on your strategy.

- Monitor your account balance and performance to assess the effectiveness of your approach.

Additional Tips:

- Use realistic settings: Set your paper trading account’s initial balance and commission rates to reflect real-world conditions.

- Consider slippage: Factor in slippage (the difference between the expected price and the actual execution price) to simulate more realistic trading scenarios.

- Keep a trading journal: Document your trades, the reasoning behind your decisions, and the outcomes to track your progress and learn from your experiences.

- Practice regularly: Consistent practice is key to improving your trading skills and building confidence.

By following these steps and incorporating best practices, you can effectively set up and utilize MultiCharts for paper trading, providing a valuable learning experience before venturing into live trading.

Tips for Effective Paper Trading with MultiCharts

Paper trading is a fantastic way to test strategies and build confidence before risking real money. MultiCharts offers a robust platform for this. Here are some tips to maximize your learning experience:

1. Realistic Settings:

- Historical Data: Use real historical data that accurately reflects market conditions.

- Commission: Set your commission rates to match your intended broker.

- Slippage: Factor in potential slippage, especially during volatile periods.

2. Strategy Development:

- Keep it Simple: Start with a basic strategy and gradually add complexity as you gain experience.

- Backtesting: Thoroughly backtest your strategy to identify potential flaws and optimize parameters.

- Forward Testing: Use out-of-sample data to validate your strategy’s performance in real-time conditions.

3. Risk Management:

- Position Sizing: Establish a risk management plan to determine appropriate position sizes.

- Stop-Loss Orders: Implement stop-loss orders to limit potential losses.

- Take-Profit Orders: Set take-profit orders to capture profits when your strategy is successful.

4. Emotional Control:

- Detach from Outcomes: Remember that paper trading is a learning process. Don’t get emotionally attached to profits or losses.

- Stay Disciplined: Stick to your trading plan and avoid impulsive decisions.

5. Continuous Learning:

- Education: Stay updated on market news, economic indicators, and technical analysis techniques.

- Analyze Performance: Regularly review your trading performance to identify areas for improvement.

- Seek Feedback: Join trading communities or forums to discuss strategies and learn from others.

6. MultiCharts-Specific Tips:

- Customization: Customize MultiCharts paper trading to your preferences, including chart layouts, indicators, and alerts.

- Scripting: Learn to use MultiCharts’ scripting language to automate tasks and create custom indicators.

- Community Resources: Take advantage of MultiCharts’ online community for support, tutorials, and shared strategies.

By following these tips, you can effectively use MultiCharts paper trading to develop your trading skills and prepare for real-world trading. Remember, consistency, discipline, and continuous learning are key to success.

Transitioning from Paper Trading to Live Trading

Transitioning from paper trading to live trading is a significant step. Here are some key considerations to help you make a smooth transition:

1. Emotional Preparedness:

- Realize the Risks: Understand the potential financial risks involved in live trading.

- Manage Emotions: Develop strategies to control emotions like fear and greed that can impact decision-making.

- Practice Mindfulness: Consider mindfulness techniques to stay calm and focused during market fluctuations.

2. Financial Planning:

- Set a Trading Budget: Determine how much capital you’re comfortable risking.

- Create a Risk Management Plan: Establish clear rules for position sizing, stop-loss orders, and take-profit targets.

- Consider a Trading Journal: Keep a detailed record of your trades to analyze performance and identify areas for improvement.

3. Broker Selection:

- Research Brokers: Compare different brokers based on fees, platforms, customer service, and regulatory compliance.

- Choose a Reliable Broker: Opt for a broker with a strong reputation and a track record of security.

- Test the Platform: Ensure the broker’s trading platform is user-friendly and meets your specific needs.

4. Gradual Transition:

- Start Small: Begin with a small portion of your trading capital to minimize risk.

- Maintain Discipline: Stick to your trading plan and avoid impulsive decisions.

- Review Performance: Continuously monitor your performance and make adjustments as needed.

5. Continuous Learning:

- Stay Informed: Keep up-to-date with market news, economic indicators, and industry trends.

- Seek Education: Consider taking additional courses or workshops to enhance your trading knowledge.

- Join Trading Communities: Network with other traders to learn from their experiences and share insights.

6. Professional Guidance:

- Consider a Mentor: A mentor can provide valuable advice and support as you transition to live trading.

- Seek Financial Advice: Consult with a financial advisor to ensure your trading aligns with your overall financial goals.

By following these steps and maintaining a disciplined approach, you can successfully transition from paper trading to live trading. Remember, patience, risk management, and continuous learning are essential for long-term success.

Conclusion

MultiCharts paper trading is an excellent way to learn the ropes of trading without risking your capital. Whether you’re a beginner looking to practice basic trades or an experienced trader testing complex strategies, MultiCharts paper trading provides a robust platform that mirrors real-world market conditions. By using the platform’s powerful tools, data, and analytics, you can gain valuable insights, refine your strategies, and eventually transition into live trading with confidence.

Leave feedback about this